A family guarantee is a powerful tool that can assist children in purchasing their first home without the burden of saving a large deposit. In an environment where property prices often rise faster than savings can accumulate, this option allows first-time buyers to enter the market sooner, with the support of parents who have built equity in their own property.

The primary benefit of a family guarantee is that it removes the immediate need for a significant deposit. In many cases, lenders require a deposit of 20% of the purchase price to avoid lenders mortgage insurance (LMI). For young buyers, particularly in today’s market, this can be a daunting amount to save. A family guarantee allows parents to use the equity in their home as security for the loan, reducing or eliminating the deposit requirement altogether.

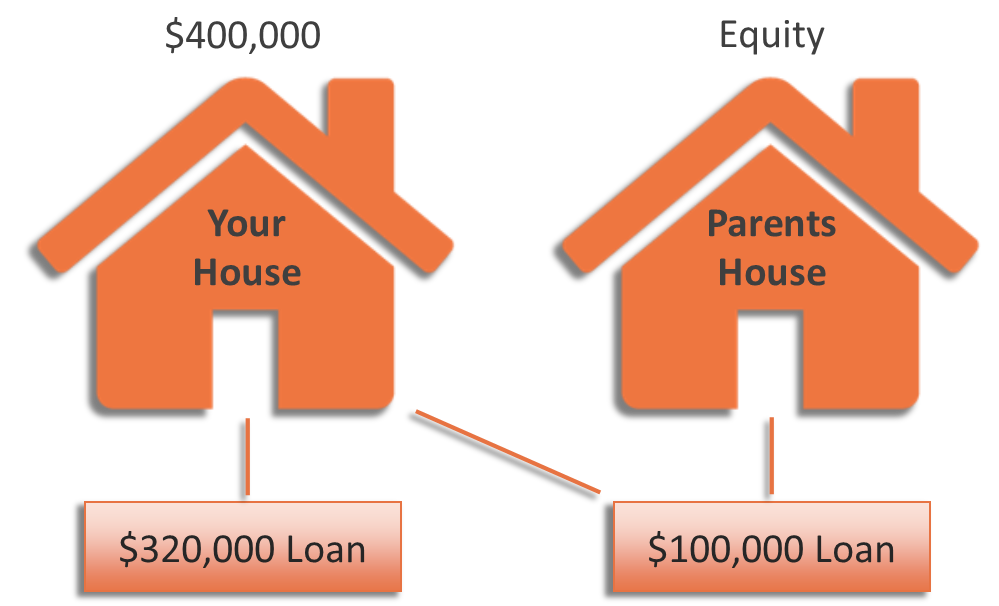

It’s important to note that parents aren’t guaranteeing the entire mortgage, which is a common misconception. Instead, they are providing a limited guarantee, typically covering up to 20% of the property’s value. This arrangement minimises the parents’ financial exposure while still offering crucial support to their children. Additionally, the guarantee is usually only required for a short period of time. Once the purchased property increases in value and the loan balance decreases, typically within the first two years, the guarantee can often be removed. At this stage, the borrower may be able to refinance or restructure their loan, leaving the parents’ property unencumbered.

Another advantage of a family guarantee is that it allows children to retain any savings they’ve managed to accumulate. Rather than pouring every dollar into a deposit, these savings can remain untouched, serving as an emergency buffer or cash reserves. This provides financial stability for the borrowers, giving them greater security in case of unexpected expenses or changes in circumstances.

For parents with sufficient equity in their property, offering a family guarantee is a practical way to help their children get a foothold in the property market. It’s a flexible arrangement that limits their risk while giving the next generation a head start on homeownership. As an experienced mortgage broker, I’ve seen firsthand how a family guarantee can open doors for first-time buyers, allowing them to achieve their homeownership goals with far less financial strain.